We started off this year with the intent to share with our blog and newsletter readers one stat-based article a month. We began with the Prosperity Index and Transparency International’s Corruption Perception Index – and we even wrote about why and how to use stats when researching overseas markets.

Then COVID happened.

We realised that our readers and clients were interested in other issues such as doing business in Latin America right now or the opportunities that still exist across the region. We moved from sharing with you some thoughts on how to use stats to tips on how to videoconference with Latin Americans.

At the same time, suddenly not many stats were that relevant. SMEs interested in navigating Paraguay, Chile or Peru today cared little in March about how much these countries had exported in 2019 or what the agricultural output for Uruguay or Argentina had been that year.

But one indicator stands out.

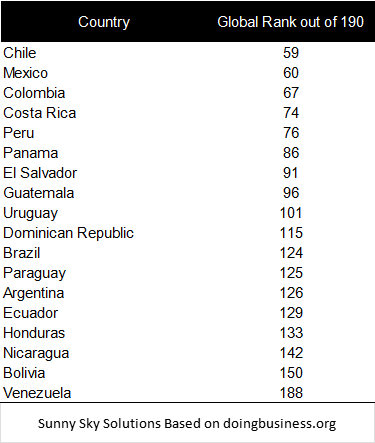

The World Bank Doing Business Ranking is one of the best sources of information that allows exporters to consistently compare issues around regulations and intellectual property across the world and over a long period. It is a free, easy-to-use tool ideal to research and compare 190 markets.

You can’t do much about regulations.

You cannot change these barriers and all you can do is be aware of them, find the right partner(s) to navigate them, adapt, and adjust your expectations. We wrote about this back in 2018.

There are many ways in which you can use the Ranking for Latin America.

For example, you can use the ranking as one of many criteria to select the markets you are going for in region (because Latin America has 20+ countries and it’s sometimes difficult to know where to start).

It can also help you refine your search criteria for a distributor – if the market you are going for is highly complex in terms of regulations, you need to make sure your chosen partner has the experience of dealing with them. Understanding where your chosen markets sit in this ranking will help you also better manage your expectations about the market.

I recently wrote about the questions you should ask yourself about doing business in Latin America. Looking at this ranking will help you refine those questions: are you ready for these markets? Can you handle their regulatory environments? Will your products/services need to be adapted? Are there any opportunities that these regulations give you that might not be present in your other markets?

Let us share with you some very important conclusions from looking at the data.

As a region, Latin America is not easy for doing business.

Don’t we know that!

Out of the 190 countries in the world (1 = fantastic, 190 = very ugly), the best we can as a region do is 59.

But, as we always say, we are not all the same.

From the table above you can see that while Chile and Mexico rank 59th and 60th, respectively, Bolivia ranks 150th. And we are not even mentioning Venezuela.

Hang on, we aren’t that bad.

When choosing export markets, you are not just comparing Latin American countries against each other, you are possibly also comparing the region’s countries to markets in other regions. Bulgaria ranks 61st and India 63th, both below Mexico and Chile. Vietnam ranks 70th and Luxembourg 72nd, both worse than Colombia and very Close to Costa Rica and Peru.

How do we perform in the aspects you are interested in?

Look deeper into the ranking, because it includes a few different aspects of doing business that might be more relevant to you than the overall score.

For example, how easy it is to open a business in a particular country in Latin America might be totally irrelevant to you if you are going to operate via a distributor. That will skew the overall ranking of your target market and give you a misleading figure (by the way, did you know it is quicker to open a business in Chile than in Portugal, in Uruguay than in Serbia?).

You might be more interested for example in the ease of accessing credit, which is critical if you are selling expensive capital goods, for example. Did you know that Mexico and Colombia rank 11th out of 190 countries, both above Canada?

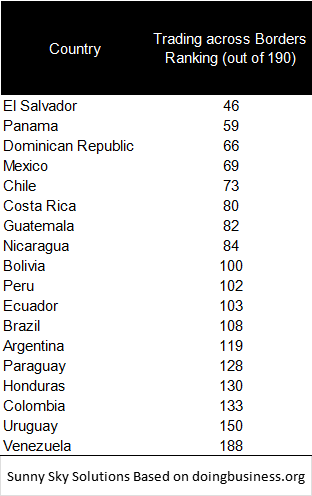

And most of you will be interested in “trading across borders”:

As you can see, we struggle in these aspect as a region. For example, Uruguay performs rather badly here, even though it can be an excellent market for many other reasons. Because Uruguay stands out in so many aspects, exporters often oversee this and then struggle with a host of complexities they could have researched better to start with.

Other interesting aspects the ranking covers include dealing with construction permits, registering property, and enforcing contracts, for example.

Needless to say, this is just one ranking and should never be the only basis for deciding on an international trade strategy. When we research markets for our clients we use a wide range of indicators, apart from studying the particular market for their product/service in detail, including interviewing sector experts and potential clients.

The World Bank Doing Business ranking is a good place to start. It will trigger interesting conversations with your colleagues. The questions you ask yourselves are probably more important than any smart conclusions we can draw from all these tables. If we can help answer them, or at least think about them with you, you know where to find us!