The advantage of working from within Latin America but at the same time talking to UK manufacturers every day (having lived there 13 years) is that I get to hear both sides of the story. I can relate to the manufacturer who is looking at Latin America for business and I can relate to the Latin American distributor or client who is looking at that British supplier to fulfil a need, too.

When asked about which sectors in Latin America demand British products, I always say “all”, because I know from my daily experience in the region that Latin America needs and is looking for imported products.

That’s why I was delighted to read about the recently released 2017 UPS Business Monitor™ Export Index Latin America (BMEI) report. The survey covered 2,170 companies in industrial manufacturing, automotive, apparel and high-tech. The Latin American countries covered were Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Mexico, Panama and Peru.

To me, the key finding of the report that I’d like to highlight to UK exporters is:

“Almost half (47%) of the importers interviewed responded that they are actively seeking new international suppliers, which suggests that there is an opportunity for exporters to find new buyers and increase their sales in the region.”

I would like to stress here the word “actively”. Half of Latin American importers are actively looking for suppliers like you… sounds like there could be opportunities there!

So think about it from the Latin American importer perspective… how would an importer try to find you? The UPS research sheds some light into this question:

“Industry fairs and trade shows were named as the most widely used offline channel for finding new suppliers (28%). Trade missions were named as the second most frequently used channel.”

That should give you some food for thought. Let’s explore on our next blog post how to make sure you make the most out of these channels to recruit the best importers and distributors (*).

So, when an importer is looking for you, what tools do they use?

“The most widely used online channels for searching for new suppliers cited were search engines (32% of total responses), followed by the importer’s response to contact initiated by the vendor via email (22%) and supplier advertising received by email (10%).”

If a third of importers are looking for you online, this to me means that you website should be pretty brilliant, and that investing in translations is a good move (Spanish and Portuguese, remember!) as well as on digital marketing and SEO.

But not every importer is quite as proactive…

“There was a high percentage of importers who indicated that they do not actively search for suppliers via offline channels, but rather they expect potential suppliers to contact them (21%).”

We surely know about this, since the most popular service we offer as consultants is distributor recruitment, which means we speak to probably about 50-100 Latin American importers every month. That means you will have to be proactive and reach them, they are certainly waiting for you!

Now, let’s imagine you and your potential importer get in touch, finally. What are they looking for?

“When asked about the main factors taken into account when evaluating a potential supplier, importers indicated that they look at several aspects, from the product itself to the services a seller may offer to facilitate purchases. Product quality and price were the two top responses, followed by seller services, such as, more flexibility in payment terms and after-sales services.

Interestingly, the majority of respondents cited several factors as highly important. Three out of every four respondents (74%) cited five factors as highly important: price, quality, logistics services, flexible payment terms and after-sales services, with no single one heavily outweighing the others. Logistics tracking tools and promotional tools were still rated as highly important by over half of all respondents.”

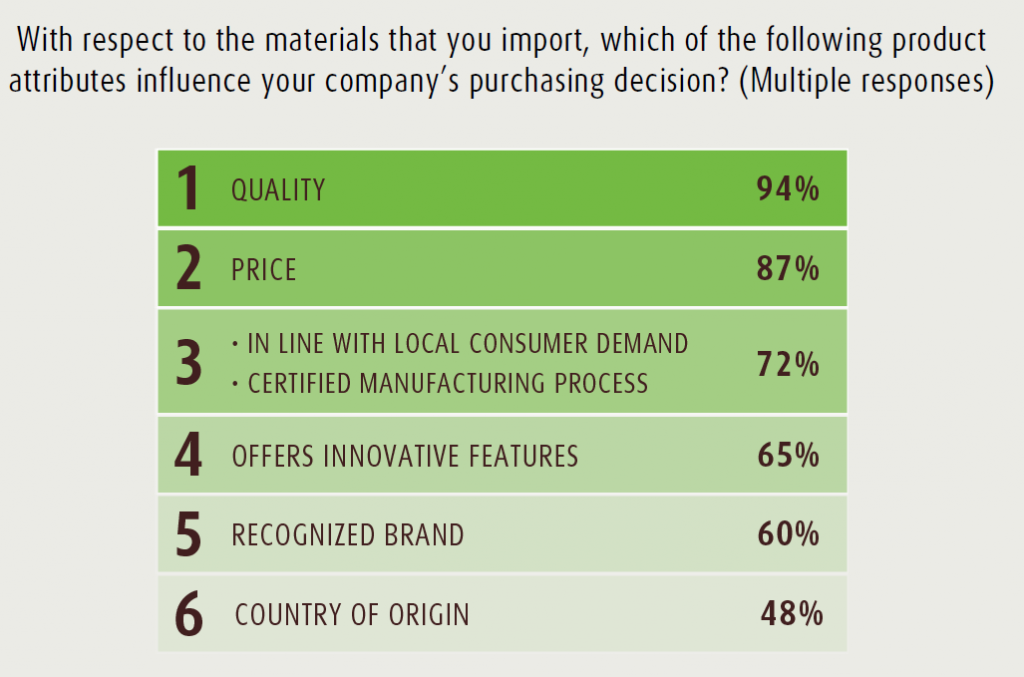

How do you score on those aspects? And how do you score on the attributes below?

Source: 2017 UPS Business Monitor™ Export Index Latin America (BMEI) report

Price and quality don’t come as a surprise, but check out the importance of innovation and origin. I always say that Made in Britain pays off…

Definitely an interesting piece of research, no doubt, and plenty for UK exporters to reflect on.

What do you think about the research conclusions? What are you going to change to improve your business in Latin America? What’s your experience with importers in the region? Leave us your thoughts below or join the discussion on Twitter!

(*) to make sure you don’t miss our next blog post on this issue, do sign up to the monthly newsletter!

Hello,

I am importing clothes from São Paulo/Brazil to Londres/UK.

I would like to get a quote with you.

Parcels:

1 box – 33kg (L. 63cm, H. 58cm, W. 54cm).

1 box – 42kg (L. 63cm, H. 58cm, W. 54cm).

Please tell me the price or tell me the best way to make a better price because I can share the goods in smaller boxes.

I am looking forward to hearing from you.

Danilo Pereira

Hi, we are not freight forwarders, we recommend you contact http://britainlatinamerica.co.uk/

All the best

Gabriela