One thing that often perplexes business people from outside Latin America, particularly from countries like the UK, Ireland, or New Zealand, to name a few, is how disruptive elections often are across Latin America.

Why are elections such a big deal in Latin America and why should you be aware of what’s happening on the electoral front? Here we explore some of the reasons.

Elections change the speed at which decisions are made.

Even if the need for a product or service remains the same before and after an election (there are good reasons why needs could change but let’s focus on unchanged need for now), the speed at which decisions are made changes – things will more often than not slow down before an election and speed up some time afterwards.

This is often the case because a change in local or national government in our region often means new policies, new focus, new people, and even new strategies. Continuity is a lot weaker than, say, in the UK. So uncertainty is high and therefore risk is high, too, so many private and public buyers will not make decisions in such an uncertain context. This will particularly affect you if you are new to a market, since potential partners will often delay decisions on new brands they represent until things are a bit more certain. If you have been working in a local market for a while and your brand is well-established, the impact should be lower (hence the importance of thinking long-term, which we’ll discuss later).

Elections mean interlocutors change.

In the UK and other countries, the body of civil servants remains the same no matter who wins an election. In our countries, whole teams change, so the people you or your local partners are talking to might change, too. And we’re not talking about corruption here, but contacts open doors (we discussed this recently on our “amigocracy” post) and if contacts change, doors could close, or open (corruption does exist, of course, and varies across countries, as we have discussed here).

Consumer/business sentiment is key.

Elections have a huge impact on business sentiment. Take Uruguay, for example, probably the most stable democracy in South America. One of the key factors for increased investment by the agricultural/livestock sector recently has been the triumph of the centre-right coalition government led by Lacalle Pou. Farmers just feel more confident under the Partido Nacional government than they felt under the left-wing Frente Amplio in the previous 15 years. Consumer and business sentiment can for example affect exchange rate and liquidity, too. For example, uncertainty surrounding election results often drives Latin Americans to save, and often in US dollars.

Electoral processes can be very long.

That often means that uncertainty can last many months – the months before the elections, the first round, the second round, and the interim period between the final results and when a new government takes power. For example, here in Uruguay we had elections in October 2019, a second round in November, and the government took power in March 2020. In that context, even in very stable Uruguay, many businesses would halt/delay decisions between August/September of one year and April/May of the following year (once the new teams are in place and policies announced).

Also, remember there are national and local elections, so the ups and downs could be repeated every other year.

It’s sometimes extreme left v extreme right.

To all the above, we must add the fact that elections often mean choosing between extremes, like nationalising/privatising mines and utilities, for example. That’s what’s happening in Peru right now.

Politicians have way too much power.

And we don’t just mean dictatorships here. In most Latin American countries, the state structure, the civil service and processes in general are weaker than politicians, so elections have a lot of weight.

This also means, going back to our earlier point, that in some particular cases, the need for a particular product or service can sometimes vanish but sometimes actually appear depending on who’s in power and what policies and priorities they have.

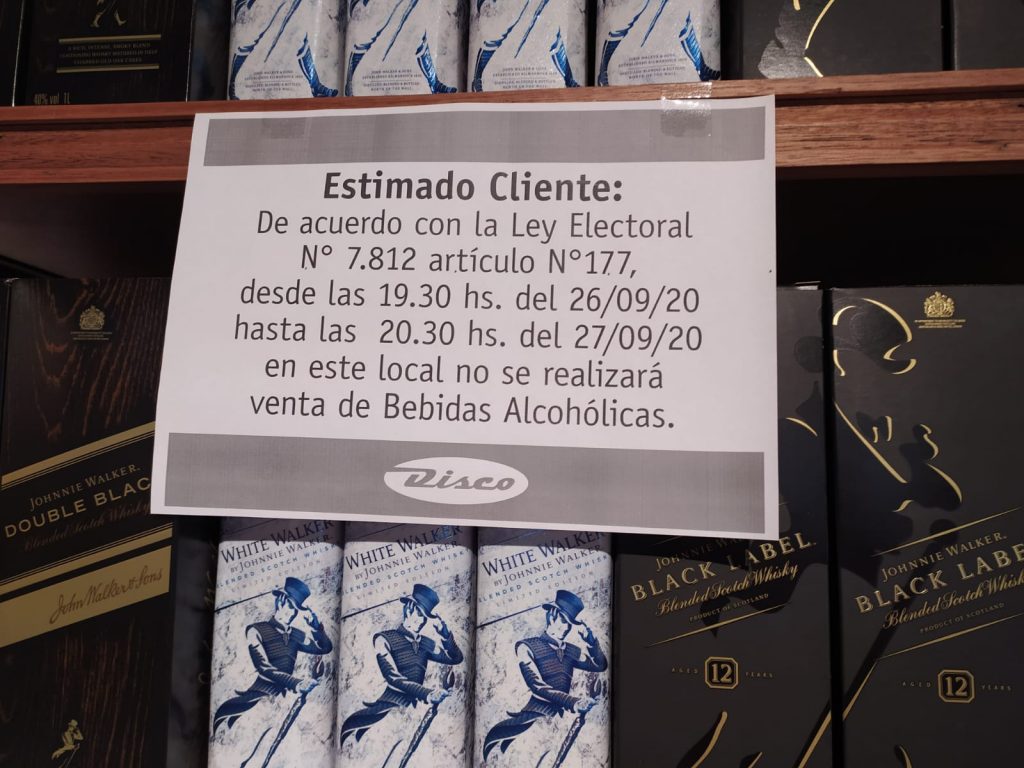

State interference is high in Latin America.

The state can define the price of fuel or electricity, for example. Take Argentina – not only government can change the price of gas overnight but it can also stop selling gas to companies (it’s done it before) or it can ban exports without any notice (we discuss the recent beef export ban here). That would be unthinkable in other parts of the world.

It is important to bear in mind that:

* There are some more stable countries like Uruguay, Costa Rica and Chile, were impacts will be lower than say, in Argentina, Bolivia or Ecuador.

* The impact of elections is not always negative, it can be quite positive, too, depending on what you sell and who to.

* There are sectors and businesses particularly affected by electoral results, like defence or public works.

* Even for sectors that are not affected directly, the impact through business sentiment is always there, so it’s important to have at least a basic grasp of what’s going on, no matter what sector you work in.

* There is a lot you should be doing even when decision-making is paralysed, like working on that relationship with your local partner, training, or developing marketing materials, for example.

* You shouldn’t necessarily be writing off an election year – your competitors certainly won’t.

* What happens and gets said during election campaigns is not what might happen afterwards. When Menem was elected in Argentina, many expected very left-wing policies yet it was arguably one of the most liberal governments the country ever experienced.

It is also important to:

* Distinguish between what media report and what businesses are doing. While headlines can be very shocking, particularly English-language media, often businesses just get on with it, basically. If you check out our LinkedIn company feed, for example, you will see regular business news from the region (with a focus on agrifood) that will hardly ever make it to mainstream English-language media.

* Demand is still there, in most cases, what changes is the speed – on average, you might sell the same in a year, but the distribution per month could vary a lot.

* Remember to trust your local partners, they will have the accumulated experience of many, many elections, and can guide you through them. Be patient, they will want to sell as much as you do, but they will also understand the right timing for it.

We always say that if you think strategically, you’ll know what you can achieve on average over 5-10 years in Latin America. There’s never a perfect time to enter a market, at some point you just need to take the plunge and go for it. What will matter is how you do it and at what pace – and who with. But if you’re waiting for calm waters, you’re unlikely to ever go for it. Not in Latin America, at least!