Argentina ( * sighs * )

Where do we start?

A new government, led by Alberto Fernández, will take office on 10th December. Beyond the hype, the don’t-cry-for-me-Argentina-it-takes-two-to-tango cliché headlines and all that, what does this really mean for overseas companies doing business in South America’s second largest economy?

Let us clarify that we are not political analysists – we recommend these articles (in English) from Americas Quarterly, The Economist, Bloomberg and The Independent if you’d like to know more. Our aim is to give you an overview of what (not) to expect, while we await specific measures and resolutions – we will certainly be writing lots on Argentina next year!

Less pro-business

Compared to Macri’s administration, the Kircheneristas (remember we have Cristina Fernández de Kirchner as VP) are, no doubt, going to be less pro-business.

Expect:

- More barriers to trade, including non-tariff barriers (protectionism on the up)

- More taxes

- Weaker international outlook

- Mercosur to become more political than commercial

- More difficulty in getting paid, as there will likely be more restrictions on foreign currency and more barriers to financial transactions

Having said that, remember that we are starting from a better position than when Macri took office since, if there is something that we can praise his government for are the improvements on the business environment: making it easier to export, more proximity to the countryside, signing the Mercosur-EU and Mercosur-EFTA FTAs, attempting to professionalise the civil service, and advancing national statistics.

Degrees of madness

Also, we are not expecting anything too insane. Crazy, maybe, but not as radical or extreme as in previous Kirchner administrations. There is little room for manoeuvring this time. A good signal of that is the recent meeting between Fernández and Macri, something unusual in recent Argentinean politics. Analysts also agree that it would be highly unlikely, almost suicidal, for the government not to ratify the FTA with the EU and EFTA. So there’s some hope. How that is actually implemented and when, we’ll see.

What we do have is a country with considerable economic, political, legal and regulatory instability. That won’t change. Argentina has some deep, structural problems to solve and not only economic, also educational and institutional. Its business competitiveness is poor, too. That makes doing business difficult, but not impossible.

On the plus side, thanks to the FTAs with the EU and EFTA, there could be better room for conflict resolution through arbitration.

An economy in shambles

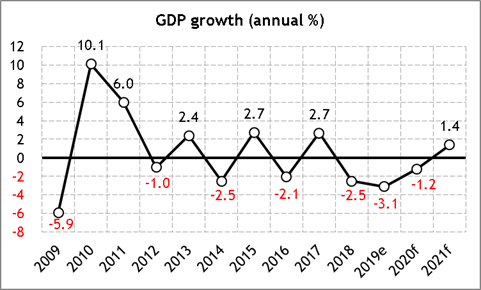

60% inflation. One third of people living in poverty. External debt. Peso devalued. Recession. Unemployment. Argentina has it all.

We can argue forever about macroeconomics but we all know Argentina’s economy has been unstable for too long. That is unlikely to improve. It’s the business environment you faced 15 years ago when doing business here, 10, 5 or today.

Source: sunnyskysolutions from World Bank data

What you can do

It is important to keep informed on developments, beyond the rhetoric, monitoring new concrete measures and how they are implemented and enforced.

Having a local partner in Argentina is a must and will become a lot more relevant now because of a very likely increase in bureaucracy, and because of more difficulties relating to payment and financing. Selling direct will become more and more difficult and risky.

If at all possible, visit. Nothing beats seeing a market for yourself, particularly if you are making big investments or are about to make a big decision. For a country with those macroeconomic statistics, you would be amazed at how normal everything seems when you visit! There is still a strong middle class, for example, demanding imported goods and services. There are also strong sectors like food and drink, food service, audiovisual software or agriculture. Argentina is a world leader in many exports, including beef, corn, lemons, wheat and polo ponies, and servicing its export sector can a clever way to get in. It also has a sizeable internal market of over 40 million people.

Talking about visits, this year we visited Buenos Aires a few times and you always spot opportunities – see for example our posts on food service, agriculture/livestock and duty free retail. There is still business to be done in Argentina, if you know how to handle it.

The other important point is to think laterally. For example, can Uruguay be a good hub to serve Argentina, maybe through its free trade zones? Can you maybe tackle smaller cities rather than Buenos Aires?

Have a long-term strategy. Argentina is not for the short-term, it needs to make sense with all its ups and downs.

With regards to the economy, if you are there, there is probably no reason to get out in a rush. Even if it clearly won’t be more attractive under the new government, if it was an attractive market to you a year ago, then it still should be. And if you had ruled it out, you will probably keep ruling it out now. Either you can navigate a risky unstable economy or you can’t. If you can, then you can go for it after 10th December like you can today. If you can’t, it’s not a good market, it hasn’t been, it won’t (ever?) be. Macroeconomic adjustments will take a very, very long time. Don’t expect things to improve anytime soon. And don’t tell me you were hopeful under Macri that everything would turn out like a fairy-tale, we all had some illusory confidence but we all knew this is Argentina, and things change quickly and dramatically here.

Would you like us to keep you informed?

If you would like to know more about Argentina, and the rest of Latin America, and not miss any posts, then do sign up to our newsletter – you can also follow us on LinkedIn and Twitter. We also offer a bespoke briefing service for companies seeking specific sector news on a regular basis, get in touch if you would like to discuss it ()

How we can help

If you are interested in doing business with Argentina or the rest of Latin America, we offer market intelligence/research, market visits and partner recruitment services. Drop us a line and we can take it from there ()