In this blog, we have analised statistics and indexes from a range of sources for the whole of Latin America and for individual countries. Our aim is to give you figures beyond GDP, GDP per capita and other obvious indicators you probably use already for your export planning. We have covered for example democracy and press freedom, as well as transparency and peace.

This time, we share with you some thoughts based on the London-based Legatum Institute’s Prosperity Index, focusing on Latin America. We will be also looking at the Transparency International Corruption Perceptions Index this month (sign up to the newsletter not to miss out!). If you would like to know why you should bother looking at stats when researching overseas markets, check out this recent blog post.

So what exactly is the Prosperity Index?

“The Legatum Institute’s revised and improved 2019 Prosperity Index quantifies prosperity in 167 countries across the globe, which together contain 99.4% of the world’s population. Almost 300 country-level indicators, grouped into 65 policy-focussed elements, are used to measure the current state of prosperity in these countries and how it has changed since 2007.”

source: www.prosperity.com

How does Latin America perform?

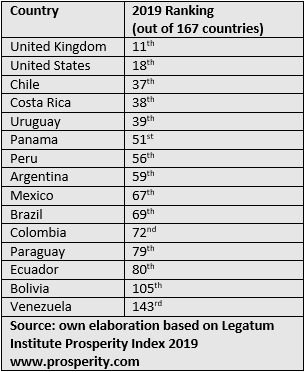

The table below summarises how some of the main countries in the region perform (and the US and the UK for reference):

As expected, the best-ranked Latin American countries are Chile, Costa Rica and Uruguay, just under Poland, and above Greece, Hungary, Romania and Bulgaria.

We could write a whole paper on what the results mean, but for now, just a few observations:

-

The best 6 countries in our region in terms of prosperity all rank above China.

-

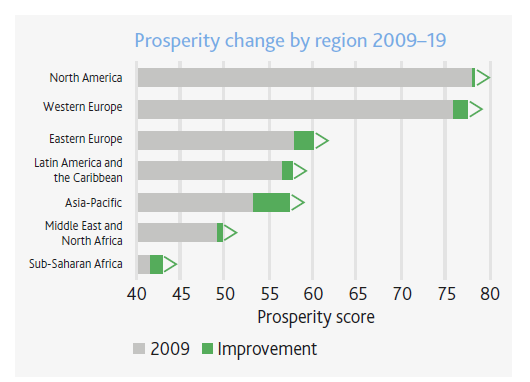

In terms of progress, Ecuador is one of the 15 countries in the world showing the most improvement in the last 10 years.

-

In terms of market access and infrastructure, Chile performs only slightly worse than Italy.

-

In terms of enterprise conditions, the top 7 countries in Latin America score better than Russia.

-

Chile ranks 11th in the whole world (not bad at all) with regards to Import Tariff Barriers, and Peru and Mexico rank better than the US.

-

Chile, Costa Rica, Brazil and Uruguay do better than China and India in terms of Domestic Market Contestability.

-

Within Domestic Market Contestability, “Market-Based Competition”, defined as “the extent to which safeguards (such as comprehensive competition laws) exist to prevent the development of economic monopolies and cartels, and the extent to which they are they enforced” (from the Bertelsmann Stiftung Transformation Index), you will find that the best two Latin American countries, Brazil and Chile, are actually better positioned than countries like Turkey and South Korea, which in turn rank similar to Uruguay, Peru and Costa Rica, all surpassing India and China in that particular ranking.

Without doubt, a very in-depth index worth exploring in detail when researching and doing business these markets. Enjoy!